Mortgage, children, charges... You're winning, but not really serene?

Every day, Yosanami gives the amount to follow to stay on the right track.

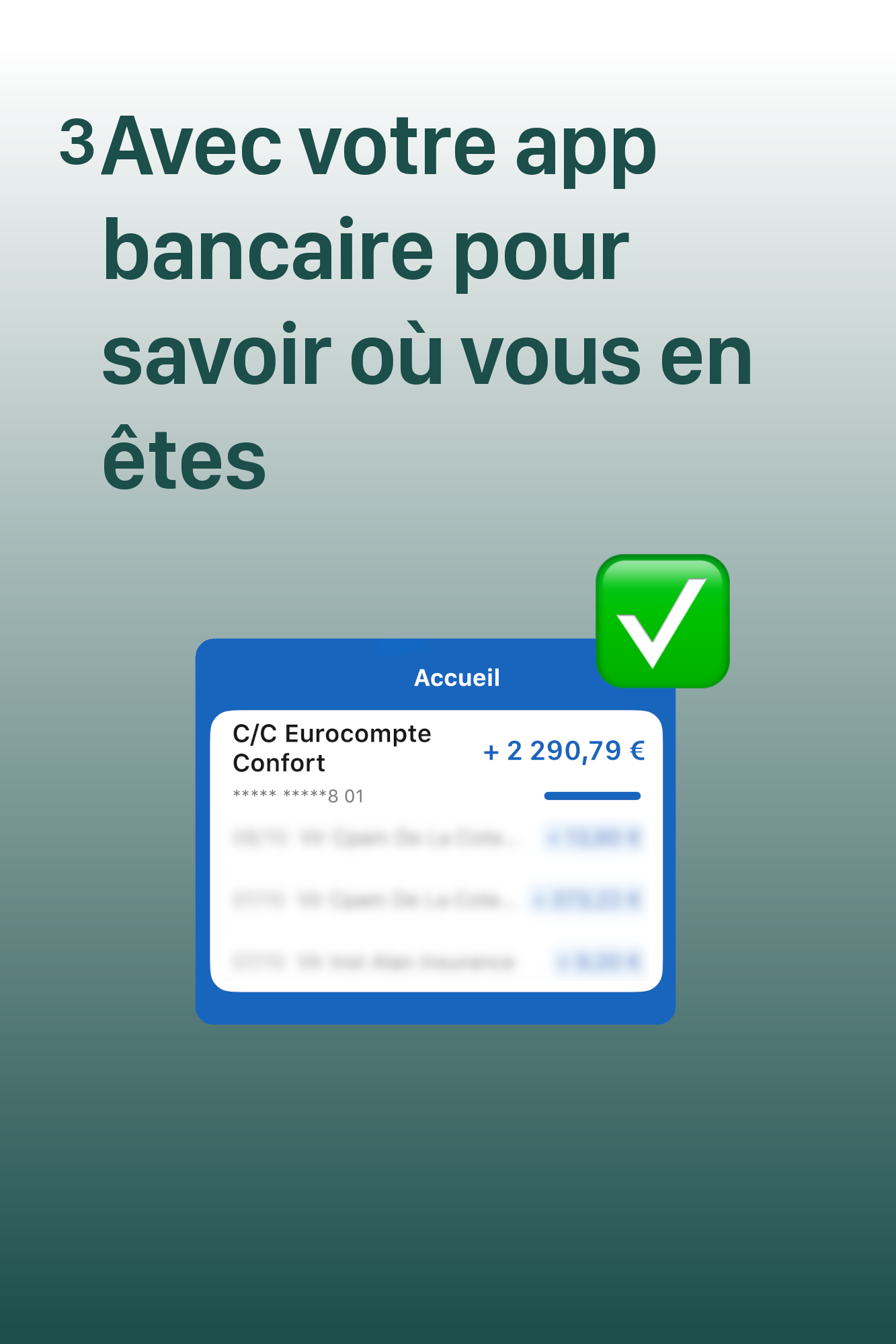

Compare with your bank app and adjust if necessary.

Free access during beta

-50% for life when the site becomes paid

€25/year instead of €50

Influence on features

Vous vivez aussi ces situations ?

On a de bons revenus, mais entre le crédit et toutes les charges, on ne sait jamais où on en est vraiment, on a tendance à ne pas économiser

Je vérifie mon compte 5 fois par jour, c'est devenu une obsession

On sait jamais si on peut dire aux enfants "c'est bon, on peut se le permettre". S'il nous reste 1 800€ mais qu'on fait l'entretien de la voiture dans 15 jours, il restera environ 1 400€, moins le reste à charge pour mes soins dentaires... C'est trop flou !

We have a joint account and two personal accounts. Since our expenses change depending on the month, we never know how much to leave on each account. So we tend to leave more and save less

I constantly calculate in my head to know if we have enough in the account: rent + groceries + gas... I'm fed up

Fini la gymnastique mentale et retrouvez la sérénité financière.

Comment ça marche ?

Yosanami helps you see clearly, simply. No complicated calculations, no pressure. Just a serene view of your budget, today and for the next 12 months.

-

Add your income and recurring expenses

Enter your income, subscriptions, rent, insurance... as well as your regular expenses like groceries, transport or daily purchases. These expenses are often predictable — Yosanami is based on your estimates, not strict calculations.

-

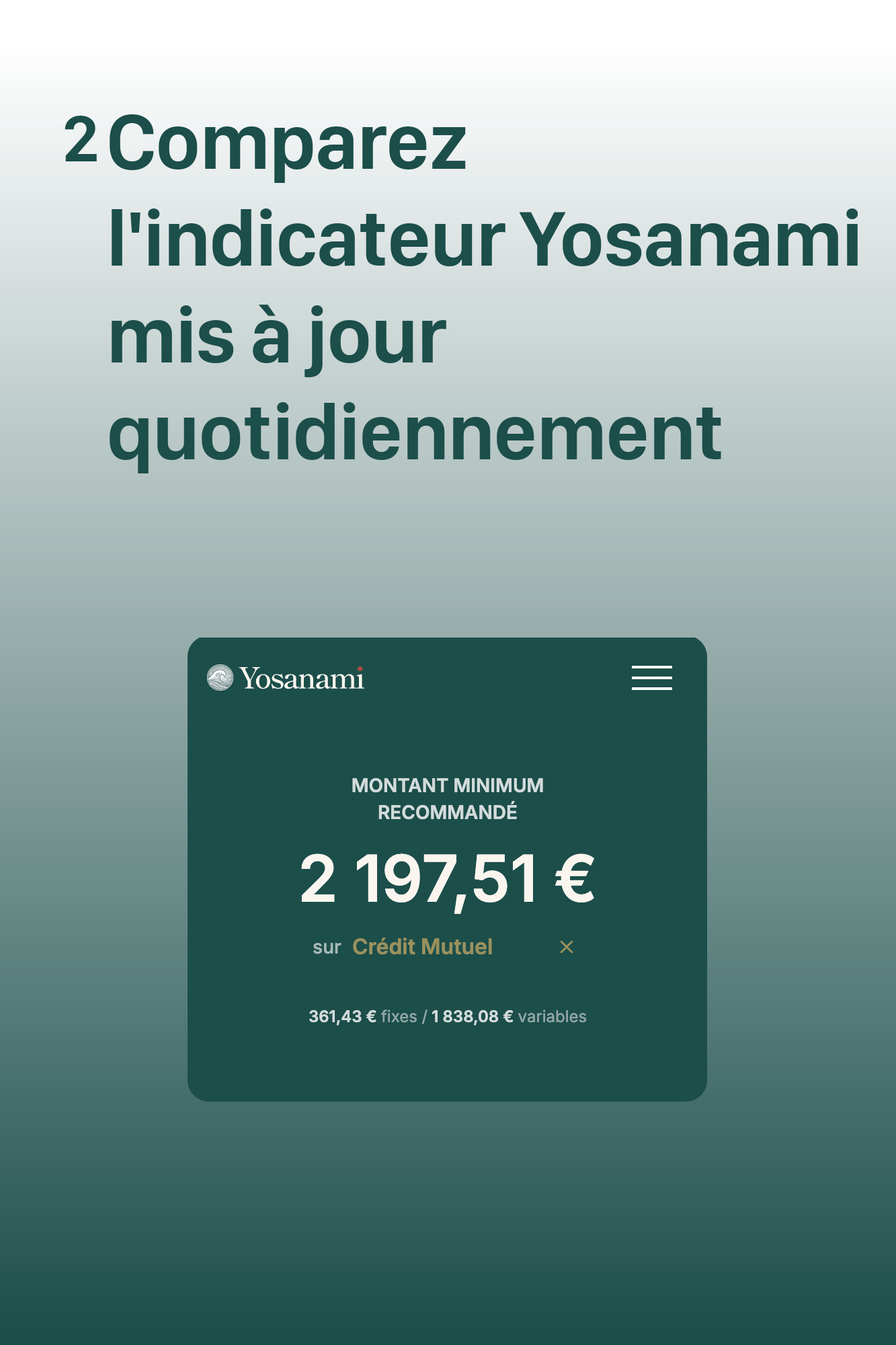

Yosanami calculates your amount needed until your next salary

Add your non-monthly expenses (car maintenance, taxes, holidays) or exceptional ones. Yosanami helps you visualize them serenely, to plan without stress.

-

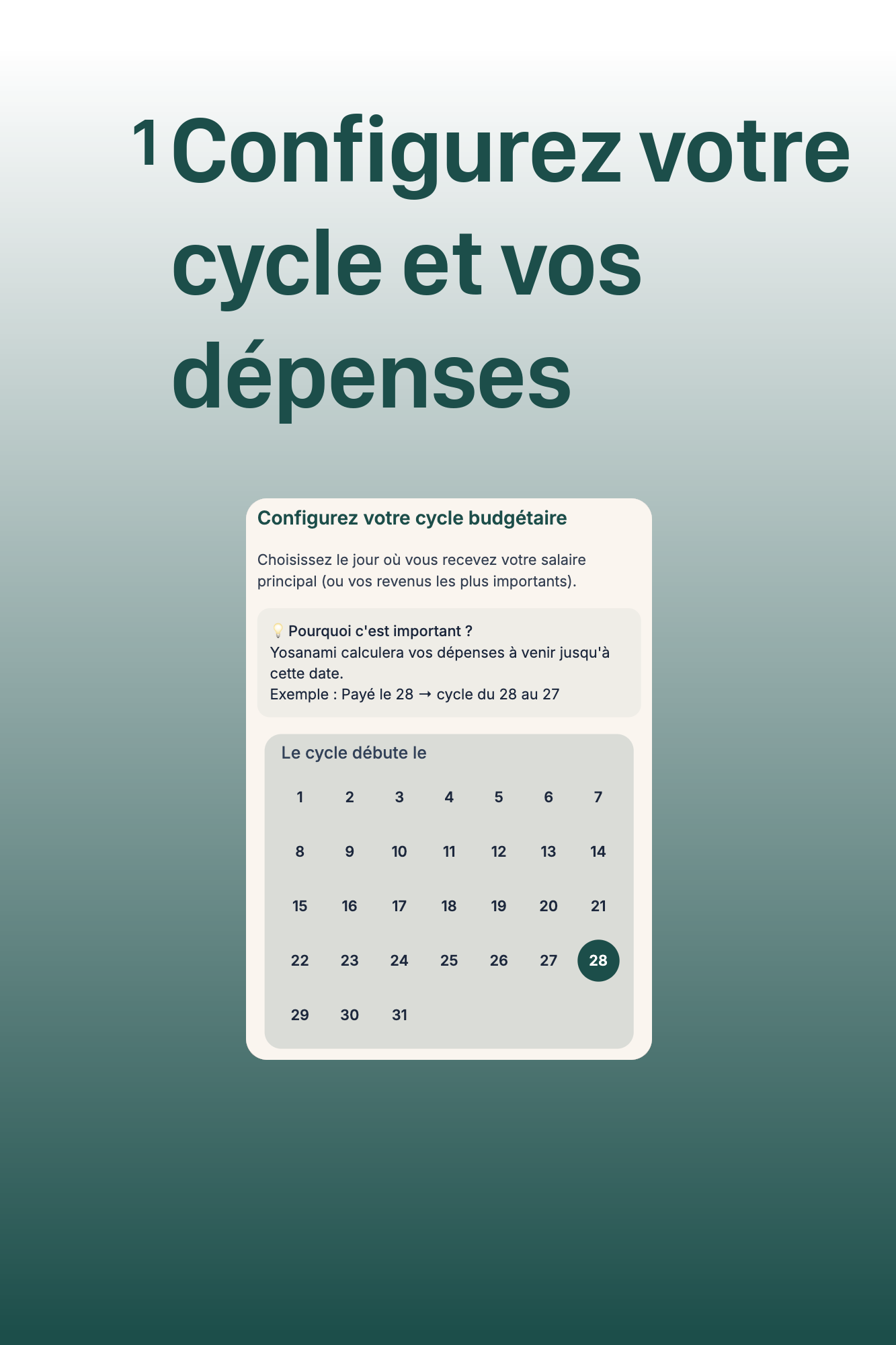

Choose your budget cycle

By default, it runs from the 1st to the 30th of the month, but you can modify it — for example to your salary date. This is actually recommended so that your forecasts match your reality.

Solde réel vs Solde estimé

-

Compare your upcoming expenses with your account balance

Adjust your spending pace day by day. Yosanami anticipates your expenses until your next income.

-

Plan serenely

You can simulate your expenses over 12 months, identify the busier periods and anticipate exceptional expenses (car maintenance, boiler, holidays...).

And that's where everything changes.

You see. You adjust. You respect your budget.

And the cherry on top: you can confidently tell the children or your partner "we can't afford it".

No more anxiety. You know.

-

Optimize your savings

By setting aside only what you need, you maintain a natural balance between security and spending freedom.

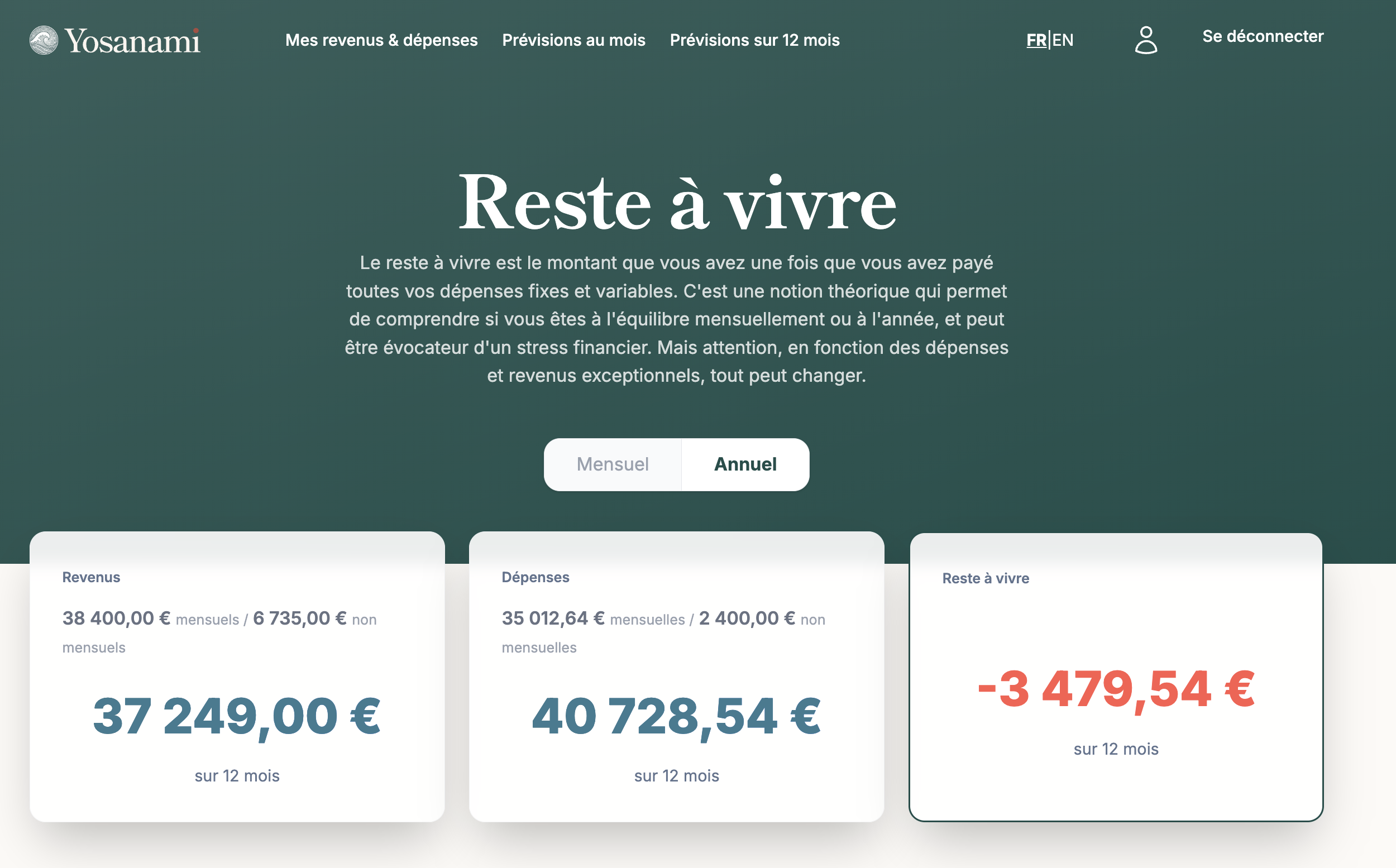

Are you in balance for the year?

Hard to say without calculating everything. Yosanami estimates your situation over 12 months taking into account all your expenses, even exceptional ones.

What matters is having a clear vision. Even based on estimates, it's infinitely better than navigating blindly.

Estimate my situationJulie and Thomas, 2 children (4 years old and 18 months)

Combined income: €4,200/month (salaries on the 28th)

Mortgage, nanny, rising grocery prices

"We earn well but always end up tight"

March timeline

Yosanami calculates:

"Expected expenses in March: €3,943"

They provision:

→ €4,000 to the joint account

→ €200 saved in the savings account

Yosanami: "Estimated: €2,643"

Bank: "Balance: €2,850"

"We're on track"

Yosanami: "Estimated: €1,343"

Bank: "Balance: €1,190"

Julie: "We spent too much on groceries.

We're being careful this week: no restaurants and we're trying to empty the canned goods in the pantry."

Yosanami: "Estimated: €50"

Bank: "Balance: €120"

Thomas: "We managed well in the end!"

What the family gained:

- ✅ Visibility: They saw the budget gap on the 15th

- ✅ Reactivity: They adjusted immediately

- ✅ Serenity: They finished the month without stress

- ✅ Savings: €200 set aside from the start

Without Yosanami:

They would have discovered the problem too late, maybe ended up in the red, and wouldn't have saved anything.

Yosanami complements your banking app

Your banking app (Revolut, Bankin, Linxo...) shows you where your money went.

Yosanami tells you where you are today and if you're respecting your budget.

The two are complementary.

Your banking app

+ Yosanami

📊 Categorizes your past expenses

🔮 Predicts your daily balance

💳 Manages your transactions

📋 Plans your upcoming expenses

❓ "Where did my money go?"

✅ "Am I respecting my budget?"

📈 Analysis

🎯 Anticipation

= Les deux sont complémentaires

Concrete example

With Revolut alone:

On March 15th, you see that you've already spent €347 on groceries since February 28th. That's nice, but it doesn't tell me how to stay within my overall budget.

With Revolut + Yosanami:

On March 15th, Yosanami tells you: "You should have €1,300 in this account today to make it until the 28th".

Conclusion

Yosanami doesn't replace your bank. It complements it.

→ Keep your banking app to manage your transactions.

→ Use Yosanami to anticipate and respect your budget.

Yosanami: the budget copilot for your banking app

What our Clients Say

Stop calculating in your head.

Start living peacefully.

Join users who have taken back control of their budget.

Free access during beta

-50% for life when the site becomes paid

(25€/an au lieu de 50€)

Influence on features

Questions ?

If this section doesn't answer your questions, please contact us using the form below.

I earn good money, is it normal to struggle at the end of the month?

Yes! Mortgage, kids, fixed costs... even with good income, you can quickly feel tight. Yosanami helps you regain control by anticipating rather than enduring.

Who is it for exactly?

Yosanami is particularly for you if:

- You never really know where you stand during the month

- You have irregular income or expenses

- You manage multiple accounts (joint, personal...)

- You already use Revolut, Bankin or your banking app and want to go further

- You want to anticipate instead of realizing after the fact

Do I need to enter everything to the cent?

No! You enter monthly estimates (groceries: ~€400, gas: ~€150). No need to track every coffee. The idea is to have an overall view, not to control everything to the cent.

Do I need to connect my bank account?

No. Everything is entered manually, without bank connection. It takes a bit of effort at first (about 1 hour), but it's more secure and you keep full control of your data.

Does it replace my banking app?

No. Yosanami complements your bank. You keep your banking app to manage your transactions. Yosanami tells you if you're respecting your budget.

We have multiple accounts (joint, personal...), does it work?

Yes! You can filter by account. Yosanami tells you how much to provision on each one. No more headaches about "how much to leave where".

What if I spend more than expected?

Yosanami shows you in real time. You can adjust (reduce groceries, postpone a purchase) or accept it and save less this month. You decide with full knowledge.

My monthly expenses are higher than my first income of the month. Does it still work?

Yes. If you receive multiple incomes during the month (e.g.: €2,500 on the 1st + €1,000 on the 15th), Yosanami takes it into account. You may see that you need to build a small safety cushion to start serenely.

Is my data secure?

Yes. Your data remains private. We will never sell it and you can delete it at any time by contacting us.

Is it really free?

Yes during the beta phase! Then, the price will be €50/year. But if you sign up now in early access, you get -50% for life (€25/year).

Do you have a question, a problem or a remark?

Our location

4 rue de la voie romaine

21560 Arc-sur-Tille, France